Proprietary trading firms generally structure their plans around a trade-off between upfront cost, risk controls, and the speed at which traders can access payouts or live capital. High fees, restrictive loss limits, and rigid consistency rules can often limit flexibility, particularly for those traders who are still finding their feet. MyFundedFutures has introduced the Flex plan as a cost-effective alternative within its lineup, designed to balance accessibility with defined risk parameters while offering a clearer and more flexible progression through evaluation and simulated funded trading.

Here’s a deep-dive into the salient features of the MFFU Flex plan and how it differs from the firm’s other offerings.

The Flex plan pricing for a $50,000 account is $107, making it one of the most affordable plans in the industry. Including the new plan, MFFU currently has three plans on the offer:

- Flex Plan

- Rapid Plan

- Pro Plan

Before delving into the new Flex plan and the merits of it, it is pertinent to know the account types offered in general by prop firms, namely

- Evaluation Account: This account type allows a gradual progression from a simulated, demo trading environment to help prove a trader’s profitability and risk management skills before getting access to the prop firm’s capital. For traders, it is a nearly risk-free way of trading in which they can build a track record without committing their capital.

- Instant Account: This allows traders to skip the evaluation phase and instantly get capital upon paying a fee for the account. This account type suits experienced traders but for novices who are yet to refine their trading strategy, it could pose a big challenge.

- Hybrid Account: As the name suggests, this account type combines the merits of an evaluation and an instant account. Traders often transition from an evaluation phase to a “live-mirror” account in which successful traders are copied to real capital. Firms use this to manage risk by allocating capital to consistent performers while retaining beginners in the evaluation phase until they prove their mettle. This account type could involve lower upfront cost and provide flexibility, while also mitigating the risks associated with an instant account but the rules could be complex, making adherence a challenge.

How Should You Choose A Plan?

Some factors prop traders typically weigh before they zero in on a trading plan that works better for them are:

- Fees, including a one-time evaluation fee for entering the assessment phase; It varies with account size, and typically ranges between $50 to over $600. Once you pass evaluation, an activation fee is charged for trading with funded capital. Other fees include reset and retry fees and monthly recurring fees.

- Profit target: A profit target is the specific amount of profit a trader must achieve, usually expressed in dollars, to pass a prop firm’s evaluation or qualify for the next stage such as a funded or sim-funded account.

- Drawdown and risk-management rules: Drawdown rules is the maximum amount a trader is allowed to lose before the account is breached or fails.This would ensure risk control and capital preservation.

- Consistency requirements: These ensure that profits are generated in a controlled and repeatable manner, rather than from one oversized or high-risk trade. Firms set daily profit caps (More than 40%-50% of profits should not come from a single day), minimum trading days before passing evaluation or requesting payouts etc.

- Payout terms define when, how, and how much a trader can withdraw from their funded account.

- Trading Restrictions: Common restrictions include

- Maximum contract or lot size

- Restricted instruments or markets

- News or event trading rules

- Time-based restrictions (e.g., no trading near market close or rollover)

- Prohibited strategies, such as arbitrage or latency trading or High-frequency or automated strategies without approval

Is MFFU Flex Plan The Right Plan For You?

Account size under the Flex plan is $50,000 for the evaluation period and for simulated funded trading.

Get Funded with Flex Plan at a $20 Launch Discount!

There is no activation fee involved while transitioning to funded simulated trading.

Initial balance, which is the amount shown in your sim-funded account at the start, used to calculate profits, drawdown limits, and payout eligibility, is $0 for a funded simulated account. Therefore, an account may go into negative balance, until the Max Loss Limit (MLL) trails up to $0 or above.

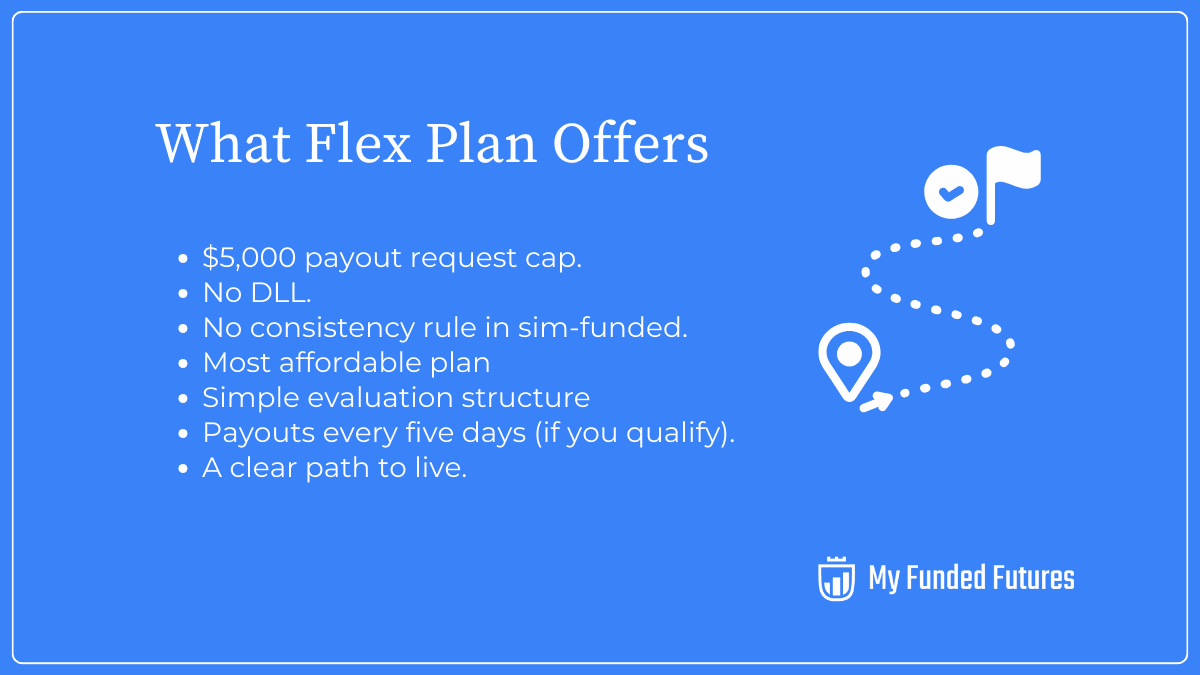

Loss Limits: There is no daily loss limit in both phases, while the MLL is $2,000. MLL is the largest total loss allowed on the account before it is automatically failed or closed. There is no buffer requirement for the sim-funded account.

Consistency requirement applies only to the evaluation phase, and the norm is no single trading day may account for more than 50% of your total profit.

Minimum trading days is as low as two for the evaluation phase.

Trading Restrictions: T1 news trading is allowed in both stages.

Inactivity period, which is the maximum amount of time a trader can go without placing a trade before the prop firm flags the account, is seven days for a sim-funded account.

Maximum contract size allowed during the evaluation period is five mini or 50 micro contracts. As far as sim-funded trading is concerned, the contract size varies depends on a trader’s current equity or profits:

| Account Equity/Profits | Contract size |

|---|---|

0-$1,499 | 2 mini/20 micro |

$1,500-$1,999 | 3 mini/30 micro |

$2,000+ | 5 mini/50 micro |

Payouts, Withdrawal, Profit Split

To qualify for a payout in the sim-funded account, a trader needs to have five winning days of $150. The MLL, which is set at $2,000 to account for evaluation risk and early trading swings, is reduced to a very small fixed amount of $100. You are free to trade the rest of the equity, but if your account loses more than $100 beyond that point, it’s considered a breach. Between payouts, a trader must achieve a net profit of at least $500 and 5 individual winning days of $150 to qualify for a new payout request.

The minimum withdrawal amount is $250 and the maximum is either 50% of the profits up to a maximum ceiling of $5,000. The payout request cap is increased from the $3,000 that was applicable for the Core plan, which has been supplanted. Profit split is set at 80:20.

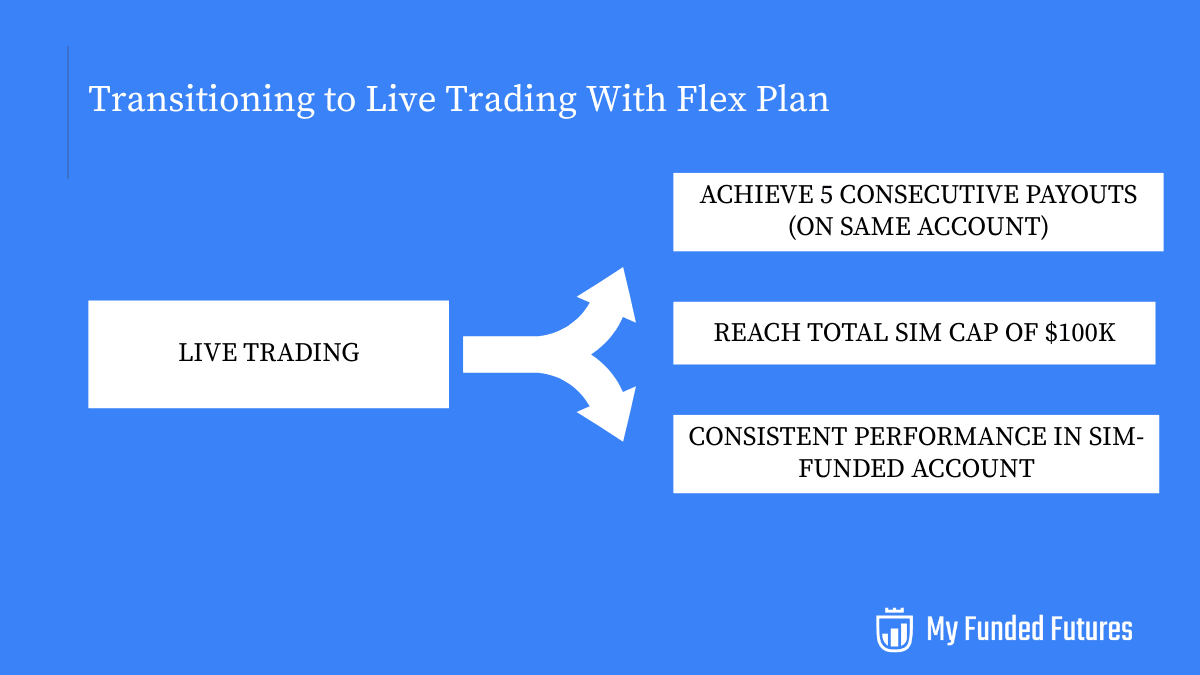

Transitioning to Live Account

The criteria for transitioning from a sim-funded account to live trading laid down very clearly.

Once live, a trader has to be mindful of the following parameters:

- Initial balance of $2,000 per account

- Minimum Balance of $156

- No DLL

- End of the day (EOD) drawdown (drawdown is calculated at the end of the trading day, and not intraday)

- Minimum Payout of $250

- Maximum contract size - 4 mini / 40 micros

What Follows A Breach

If your live account is closed following a MLL breach, a 21-day cooldown period is initiated. During this time, all sim-funded account trading, new evaluation purchases, account resets, additional account acquisitions, etc., are prohibited. Once the cooldown period expires, you can trade from your active sim-funded account and/or purchase new Evaluations or accounts.

MFFU Plan Comparisons

| Features | Flex Plan | Rapid Plan | Pro Plan |

|---|---|---|---|

Monthly Access Fee | $107 | $157, $214, $347 | $227, $344, $477 |

Account Size | $50K | $50K, 100K, $150k | $50K, 100K, $150K |

Profit Target (to pass evaluation or qualify for funded account) | $3K | $3K/$6K/$9K | $3K/$6K/$9K |

MLL | $2K (reduced to $100 after first payout) | $2K/$3K/$4.5K | $2K/$3K/$4.5K |

Drawdown mode | EOD | EOD | EOD |

DLL | - | - | - |

Activation Fee | $0 | $0 | $0 |

Maximum contract size | 5 contracts | 5/10/15 contracts | 3/6/9/contracts |

Consistency rule | No consistency rule but 50% in evaluation phase | No consistency rule but 50% in evaluation phase | No consistency rule but 50% in evaluation phase |

News trading | Yes | Yes | Yes |

Micro-scaling | 10:1 | 10:1 | 10:1 |

Minimum payout | $250 | $500 | $1k |

Profit split | 80% | 90% | 80% |

Path to Live trading | 5 consecutive payouts or hitting $10K sim-funded capital or consistent performance | Automatic live transition when $10K profit is generated within a single session/performance evaluation by Risk Management Team | 3 consecutive payouts or excess profit above $100K payout limit is transitioned to live account |

Compared with the Rapid and Pro plans, the Flex Plan stands out for its affordability and balanced rule set, making it well-suited for disciplined traders who value flexibility and gradual scaling over aggressive profit targets. For those looking to enter the prop trading ecosystem with minimal upfront commitment while still retaining a transparent route to live capital, the Flex Plan presents a compelling alternative within the MFFU lineup.

This material is provided for educational purposes only and should not be relied upon as trading, investment, tax, or legal advice. All participation in MyFundedFutures (MFFU) programs is conducted in a simulated environment only; no actual futures trading takes place. Performance in simulated accounts is not indicative of future results, and there is no guarantee of profits or success. Fewer than 1% of participants progress to a live-capital stage with an affiliated proprietary trading firm. Participation is at all times subject to the Simulated Trader Agreement and program rules.

Rate this article

Related Posts

Read our most popular posts

Which Prop Firms Offer Daily Payouts and How Do They Work?

Daily payout prop firms let traders withdraw profits far more frequently than traditional models, sometimes even from the very first funded day. Instead of waiting weeks for a payout cycle, traders can request withdrawals every day, subject to rules on drawdown, buffers, and minimum amounts. This guide explains how daily payout structures work, which futures prop firms are known for fast withdrawals, what to watch out for in the fine print, and how MyFundedFutures’ Rapid plan fits into this newer payout landscape.

What Is Scalping in Futures Trading? 5 Strategies for Beginners

Scalping in futures trading is a high-speed style focused on capturing small market movements many times a day. It rewards precision and discipline more than prediction. This guide explains what scalping really involves, how it works in futures markets, the benefits and drawbacks, and five beginner-friendly strategies you can test safely in simulation before going live.

Beginner's Guide to Trading Corn Futures on CBOT

Corn futures offer accessible margin, predictable seasonal patterns, and price drivers you can research and plan around. Here's how to trade the CBOT corn contract, from understanding tick values to building setups around USDA reports and weather volatility.