Precious metal just had a great year in 2025, buoyed by their safe-haven appeal amid persistent global economic uncertainty. The Federal Reserve’s interest-rate trajectory, an important determinant of the U.S. dollar and, by extension, dollar-denominated gold and silver, remains unclear. This policy ambiguity suggests that the rally could retain momentum in the new year.

Geopolitical visibility also remains limited. President Donald Trump’s renewed tariff threats, coupled with still-strained relations between the United States and China — the world’s second-largest economy — have further enhanced the allure of precious metals as defensive assets.

Gold, Silver Benefit From Multiple Tailwinds

Long-term secular forces such as persistently high inflation and growing fiscal indiscipline of governments globally have added further shine to the precious metals. JPMorgan says gold is benefiting from its appeal as a debasement hedge as well as its traditional role. “The metal has recently served both as a debasement hedge — or a form of protection against the loss of a currency’s purchasing power due to inflation or currency debasement — and in its more traditional role as a non-yielding competitor to U.S. Treasuries and money market funds.”

The firm views that the reduced demand for the dollar and increased central bank buying created ideal conditions for gold’s recent historic upswing.

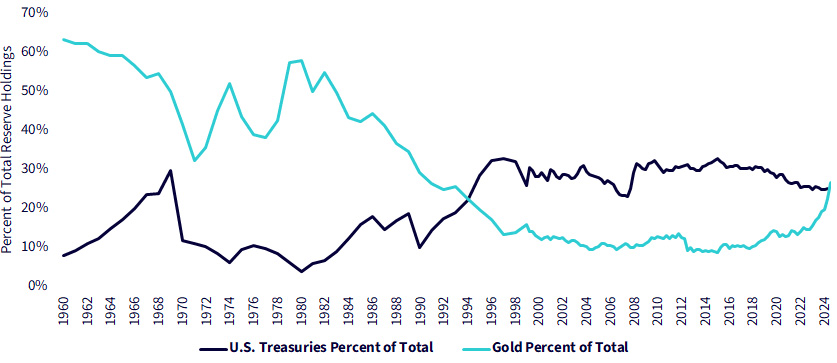

Gold now accounts for a larger slice of central bank reserves than U.S. treasuries. WisdomTree’s Global Head of Research Christopher Gannatti says the development questions dollar’s hegemony and points toward the rising need for geopolitical hedges.

Source: WGC, IMF, IFS, COFER data via WisdomTree

Precious Metal Rally Far From Over?

Wall Street’s biggest firms are hopeful that these precious metals will sparkle yet again in 2026. Delving into gold’s pulling points, Morgan Stanley Metals & Mining Commodity Strategist Amy Gower said, “Investors are watching gold not just as a hedge against inflation, but as a barometer for everything from central bank policy to geopolitical risk.”

“We see further upside in gold, driven by a falling U.S. dollar, strong ETF buying, continued central bank purchases and a backdrop of uncertainty supporting demand for this safe-haven asset.”

A weaker dollar and likely interest rate cuts could also provide tailwinds for precious metals. The U.S. economic growth is set to remain a touch soft, below trend-like growth, which is a net dollar negative and positive for the precious metals. According to the Fed’s latest Summary of Economic Projections (SEP) released in December, the longer-run real U.S.GDP growth is estimated at 1.8%, with the core personal consumption expenditure — the Fed’s favorite inflation gauge — remaining above the central bank’s 2% target at least until 2027.

In its 2026 market outlook released in December, JPMorgan said it expects gold to bulldoze its way toward $5,000 per ounce by the fourth quarter of 2026, likely trading at an average price of $4,753 for the full year. The firm expects silver prices to rise to $58 per ounce by the fourth quarter.

Riding The Precious Metal Surge

Luckily, for investors looking to dip their heel into the booming precious metals market, there are several avenues: Broadly the investment options are:

- Buying physical gold

- Financial instruments

- ETFs/Mutual Funds

- Futures and Options

- Mining stocks

- Digital gold/silver

- Sovereign gold bonds

A futures contract in precious metals is a legally binding agreement to deliver gold or silver at an agreed-upon price in the future.

Contrary to popular belief, futures contracts are not a safe entry point for novice investors, particularly in precious metals. The risks can be significant due to.

- High leverage, which magnifies both gains and losses

- Margin calls, requiring additional capital if markets move against the position

- Unlimited loss potential, unlike some other investment instruments

It is also important to understand the structural difference between futures and options:

A futures contract involves a mandatory obligation to buy or sell an asset at a set price and date. Options, by contrast, provide the right—but not the obligation—to buy or sell an asset at a predetermined price before or at expiry.

Costs and Tax Treatment

Holding a futures contract does not mean investing in a managed product:

- Futures are standardized instruments traded on exchanges, not actively managed portfolios

- Unlike ETFs or mutual funds, there are no annual management or advisory fees

- Investors still incur:

- Brokerage commissions

- Exchange fees

- Margin-related costs

In some U.S. jurisdictions, futures contracts may also receive preferential tax treatment compared to other investment vehicles. The 60/40 tax rule, applicable to the futures, taxes 60 percent of profits from qualifying futures contracts at the lower long term capital gains rate but the rest of the 40 percent at the higher short term rate. The split is fixed and is independent of trade duration. This effectively reduces the tax rate for the trader.

Futures vs. Physical Gold

Different investor profiles tend to favor different instruments:

Futures contracts are preferred by:

- Active traders and speculators

- Those seeking high liquidity

- Investors looking for lower transaction costs and leverage

Physical gold is typically favored by:

- Long-term investors

- Those focused on wealth preservation rather than short-term price movements

Who Should Trade Futures?

Futures are better suited for experienced traders. The high risk and steep learning curve make them challenging for beginners. For greenhorn investors, a more measured approach may help:

- Focus on investor education

- Hone skills through simulated or paper trading

- Start small and gradually increase exposure before committing meaningful capital

How Beginners Can Trade Gold/Silver Futures

After doing the due diligence, a beginner is better off choosing a broker registered with the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA). After shortlisting a broker and registering with them, one can use the demo account option provided by most brokerages, which will serve as a trial run.

One has to zero in on a trading strategy, including their risk preference and risk management techniques such as stop loss orders to protect against huge downside. It always pays to keep oneself acquainted to factors and forces that drive price actions.

Commissions are usually charged on a per-contract basis and some also offer tiered commission structure based on trade value, with a minimum commission per trade. Apart from the commission, brokerages also charge additional exchange and regulatory fees.

Gold vs Silver Futures: Contract Mechanics

Gold and silver futures are primarily traded on the Commodity Exchange or COMEX as well as the NYMEX, both part of the CME Group. The U.S. futures market is one of the three major gold trading centers, with the other two being the London OTC market and the Shanghai Gold Exchange.

The CME allows gold futures to be traded in various contract sizes, including

- the standard contract size of 100 troy ounces, trading under the symbol GC; Tick size, the smallest price movement of a contract, is $0.10 per ounce

- E-Micro gold futures of 10 troy ounces size, trading under the symbol MGC; Tick size is $0.10 per ounce

- Mini Gold futures of 10 troy ounces size, trading under the symbol QO; Tick size is $0.25 per ounce

- 1-ounce gold futures, trading under the symbol 1OZ; Tick size is $0.25 per ounce

The maintenance margin, the minimum account balance required to keep a leveraged futures or options position open, is $200,000 for GC, $2000 for MCG, $1000 for QO and $200 for 1OZ.

For the standard gold future, all 12 months may be listed as contract, the most actively traded and liquid contract months are February, April, June, August and December. Volume and open interest are concentrated in these months, The expiry is the last business day of the month or a specific data closer to the month-end.

Silver futures are primarily traded on COMEX, which is usually accessed electronically via CME Globex. The contract sizes are as follows:

- the standard contract size of 5,000 troy ounces, trading under the symbol SI; Tick size is $0.005 per ounce

- E-mini Silver contract, with size of 2,500 ounce, trading under the symbol QI; Tick size is $0.125 per ounce

- Micro Silver, with size of 1,000 ounce, trading under the symbol SIL; Tick size is $0.005 per ounce

The maintenance margin is $22,000 for SI, $11,000 for QI, and $4,400 for SIL. The most liquid and common silver futures contracts expire in March, May, July, September and December. Trading for a specific contract ends on the three days before the end of the delivery month.

The settlement for both gold and silver futures on the CME involves a cash settlement for daily marking to margin, i.e. the profits and losses from daily price changes are credited to or debited from traders margin account. The final settlement can involve physical delivery of 100-ounce gold of a minimum purity of 99.5% or COMEXsilver warrants, representing actual silver bars from an approved depository.

There are also options for “Trading at Settlement" (TAS) or “Trading at Marker.” While TAS allows traders to settle (buy/sell) a fixed difference above or below the contract's official end-of-day settlement price, with the latter the price differential is based on a specific, pre-defined "marker" price such as that of an index, not the futures settlement.

Other Key Differences

The demand for gold futures is from the need to have a store of value, for jewelry or to diversify portfolio. Silver’s demand stems mainly from industrial demand from end markets such as electronics, solar and auto.

Gold futures are seen more as a safe-haven bet than silver, which is more volatile due to its status as a precious metal and industrial metal. Silver prices react sharply to economic data, manufacturing cycles and technology demands. The price of the yellow metal, meanwhile, is influenced mostly by investment-related and central bank demand.

The smaller size of the futures market also renders it volatile, as relative to gold, large trades have the potential to swing the market. The supply of silver is less flexible, given it is a bye-product while mining other metals,

Which Futures Work Better For Beginners

Gold’s credentials as a safe-haven during economic uncertainty insulate it against any market swings during inclement geopolitical and macroeconomic challenges.Given the less erratic trading pattern, beginners could have the comfort of stability, and see gold as less ominous. Also, the more liquid nature of makes it easier for beginners to enter and exit trades quickly and therefore capitalize on the tighter spreads, i.e. the differential between the highest price a buyer will pay and the lowest price a seller will accept.

Conclusion

For beginners stepping into the precious metals futures market, gold futures are generally the better starting point than silver futures. Gold’s role as a safe-haven asset lends it relatively smoother price action, insulating it from the sharp, sentiment-driven swings that often characterize silver. Its deeper liquidity and tighter bid–ask spreads also make trade execution easier and more efficient, reducing the risk of slippage for inexperienced traders. While silver can deliver outsized gains during strong upcycles, its higher volatility and strong linkage to industrial demand raise the complexity and risk for newcomers still learning to navigate leveraged markets. As a result, gold offers a more forgiving environment for beginners to build discipline, understand futures mechanics, and develop sound risk-management practices.

This material is provided for educational purposes only and should not be relied upon as trading, investment, tax, or legal advice. All participation in MyFundedFutures (MFFU) programs is conducted in a simulated environment only; no actual futures trading takes place. Performance in simulated accounts is not indicative of future results, and there is no guarantee of profits or success. Fewer than 1% of participants progress to a live-capital stage with an affiliated proprietary trading firm. Participation is at all times subject to the Simulated Trader Agreement and program rules.

Rate this article

Related Posts

Read our most popular posts

Which Prop Firms Offer Daily Payouts and How Do They Work?

Daily payout prop firms let traders withdraw profits far more frequently than traditional models, sometimes even from the very first funded day. Instead of waiting weeks for a payout cycle, traders can request withdrawals every day, subject to rules on drawdown, buffers, and minimum amounts. This guide explains how daily payout structures work, which futures prop firms are known for fast withdrawals, what to watch out for in the fine print, and how MyFundedFutures’ Rapid plan fits into this newer payout landscape.

What Is Scalping in Futures Trading? 5 Strategies for Beginners

Scalping in futures trading is a high-speed style focused on capturing small market movements many times a day. It rewards precision and discipline more than prediction. This guide explains what scalping really involves, how it works in futures markets, the benefits and drawbacks, and five beginner-friendly strategies you can test safely in simulation before going live.

Beginner's Guide to Trading Corn Futures on CBOT

Corn futures offer accessible margin, predictable seasonal patterns, and price drivers you can research and plan around. Here's how to trade the CBOT corn contract, from understanding tick values to building setups around USDA reports and weather volatility.